Federal credit card fraud charges can result from a variety of illegal activities, such as using another person’s identity (identity theft and identity fraud) to obtain credit cards, using lost or stolen credit cards, installing skimmers on gas pumps or ATMs to steal credit card information, submitting fake credit card applications, creating counterfeit credit cards, and stealing mail to obtain cardholder information.

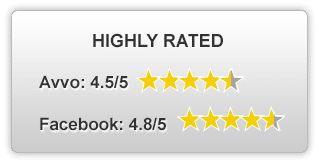

Charges of federal credit card fraud can result in serious legal consequences, including fines and imprisonment. Call 407-644-2466 to speak with a top rated Orlando criminal defense attorney at the Rivas Law Firm.

Federal Fraud Charges and Penalties

Credit cards are considered “access devices” in federal law, as in a way to access an account that’s not yours. A device can be a credit card, debit card, gift card, or any form of electronic payment. Unauthorized use of someone else’s credit card number or personal information to make fraudulent transactions, even if they never physically possess the card, can bring federal charges if the transactions involve interstate commerce. Federal credit card fraud charges can include using a counterfeit, stolen, or unauthorized credit card to obtain money, goods, or services.

Under Title 18, Section 1029 of the U.S. Code, it is a federal offense to knowingly use or traffic in counterfeit access devices, possession of fifteen or more such devices, possession of a scanning receiver, or possession of modified instruments for obtaining telecommunications services. As a rule, fraudulently receiving $1,000 or more in goods and services within a year or if fraud charges involve interstate or foreign commerce, will likely face federal charges. Additionally, credit card fraud becomes a federal charge when it involves certain federal agencies or programs, such as the U.S. Postal Service or Medicare.

The penalties for federal credit card fraud can be severe. Depending on the specific offense and the amount of money involved, a person convicted of federal credit card fraud can face up to 10 or 20 years in prison and a fine of up to $10,000 or $250,000.

Federal Credit Card Fraud Defense

If you are accused of federal credit card fraud, you need a skilled and experienced defense attorney to fight for your rights and freedom. A federal criminal defense attorney will challenge the evidence against you, question the witnesses, and raise reasonable doubts about your guilt from the very beginning. An experienced and aggressive defense attorney for federal crimes will fight to dismiss or reduce the charges, negotiate a plea bargain, or argue for a lesser sentence.

Some of the possible defenses to federal credit card fraud charges include:

– Lack of intent: You did not act knowingly, willfully, or with the intent to defraud anyone. For example, you may have used someone else’s credit card by mistake, or you may have believed that you had permission to use it.

– Identity theft: Someone else used your name, personal information, or credit card without your knowledge or consent. For example, you may have been a victim of phishing, hacking, or skimming.

– Entrapment: You were induced or coerced by a government agent or informant to commit credit card fraud that you would not have otherwise committed. For example, you may have been pressured or tricked into using a counterfeit or stolen credit card by an undercover agent.

– Insufficient evidence: The prosecution does not have enough proof to establish that you committed credit card fraud beyond a reasonable doubt. For example, there may be no witnesses, surveillance footage, receipts, or other documents linking you to the crime.

Federal credit card fraud charges are serious and complex. Your best chance for the best outcome is with an experienced and aggressive federal criminal defense attorney. If you are facing federal credit card fraud charges, contact a defense attorney as soon as possible to discuss your case and your options. Call 407-644-2466 for a free consultation with an Orlando Federal Crimes Attorney at the Rivas Law Firm.